Commercial Real Estate Cycles Across 54 Metros - Q1 2022, Dr Glenn Mueller

The demand for commercial real estate continues to evolve with a changing economy, state of the pandemic, and now global conflicts. While some property types and markets struggle, others continue to boom. Detailed market-specific insight is critical to ascertain where individual real estate markets are currently at and where they are heading.

Dr. Glenn Mueller’s quarterly Commercial Real Estate Cycles report gives just that perspective on what is going on in commercial real estate across the country with specifics for 54 metros for Apartments, Industrial, Office and Retail properties. Dr. Mueller defines four distinct phases in the commercial real estate cycle providing decision points for investment and exit strategies. Long-term occupancy average is the key determinant of rental growth rates and ultimately property values. Ideally, Phase 2 - Expansion is the ideal quadrant for real estate investor performance as shown in the following two graphs and discussion. All graphs in this summary are taken directly from Dr Mueller’s Q1 2022 report.

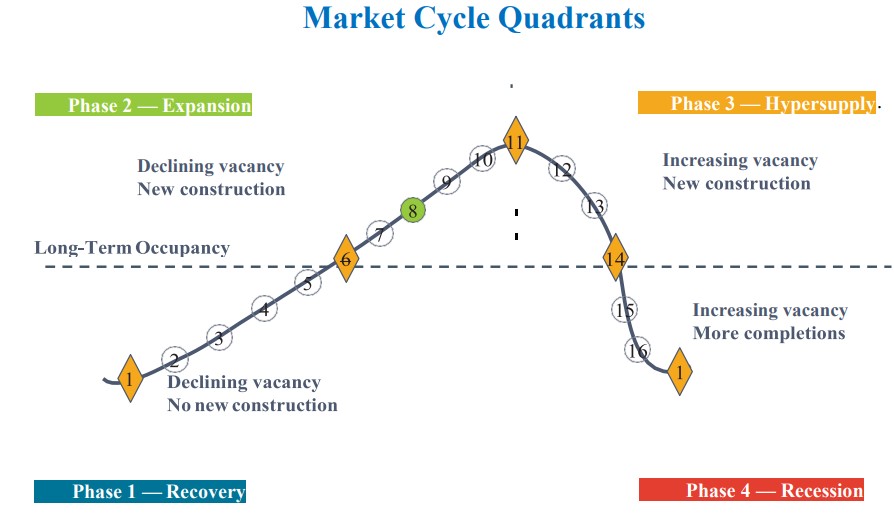

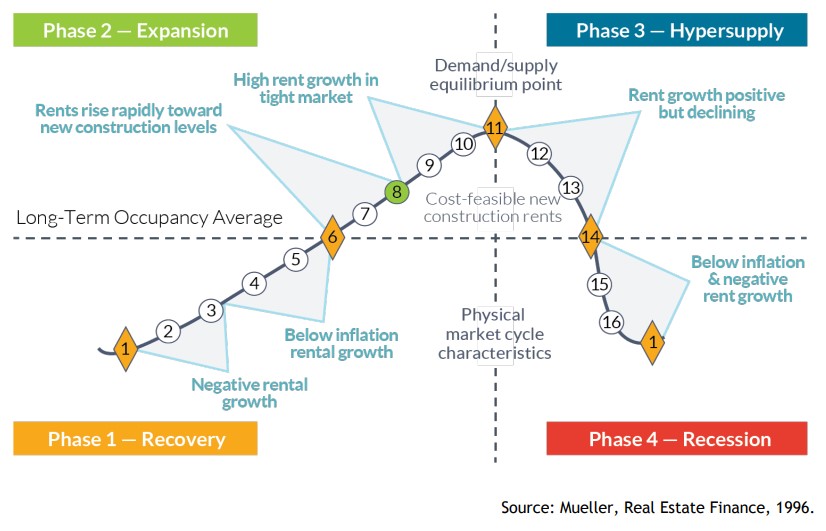

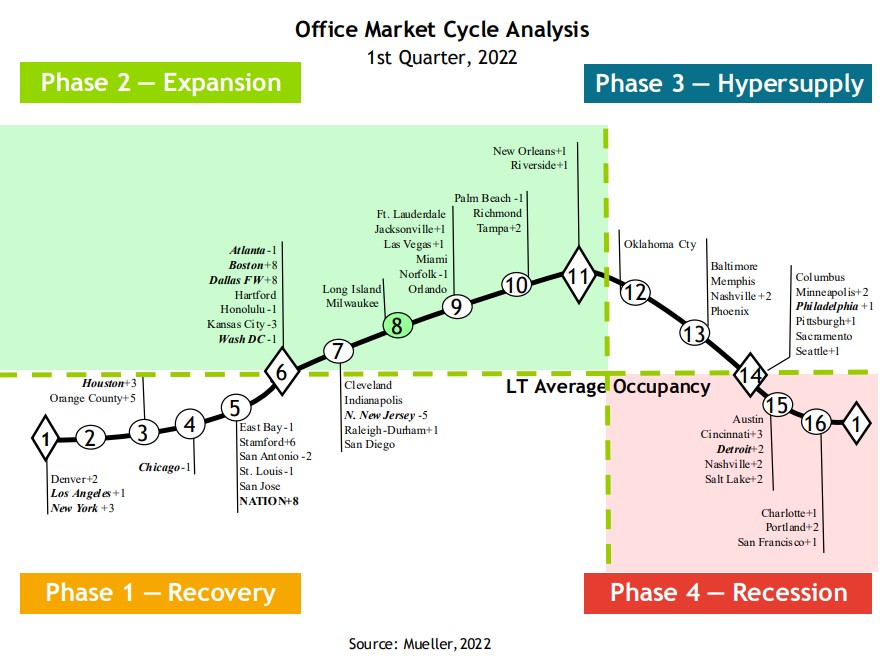

Across the cycle, Dr. Mueller describes rental behavior within each of the phases, using Market Levels ranging from 1 to 16. Equilibrium occurs at Market Level 11 in which demand growth equals supply growth – _literally the sweet spot_. The equilibrium Market Level 11 is also the peak occupancy level.

Phase 1 - Recovery _Declining Vacancy, No New Construction_ 1-3 Negative Rental Growth

4-6 Below Inflation Rental Growth

Phase 2 - Expansion _Declining Vacancy, New Construction_ 6-8 Rents Rise Rapidly Toward New Construction Levels

8-11 High Rent Growth in Tight Market

Phase 3 - Hypersupply _Increasing Vacancy, New Construction_ 11-14 Rent Growth Positive But Declining

Phase 4 - Recession _Increasing Vacancy, More Completions_ 14-16, then back to 1: Below Inflation, Negative Rent Growth

Rent growth across the cycle is characterized as follows:

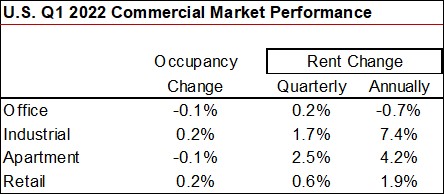

Rents and occupancy changes for Q1 2022 as reported by Mueller are detailed for the U.S. in aggregate in the following table. Ongoing big winners continue to be Apartments and Industrial properties. Retail properties show rent gains year-over-year as of Q1 2022 but Office rent is off 0.7 percent from a year ago. I believe office gains in Q1 2022 are merely recapturing part of the losses suffered in the first-half of 2021. Gains in Retail are no surprise given the material improvement in retail sales from 2021.

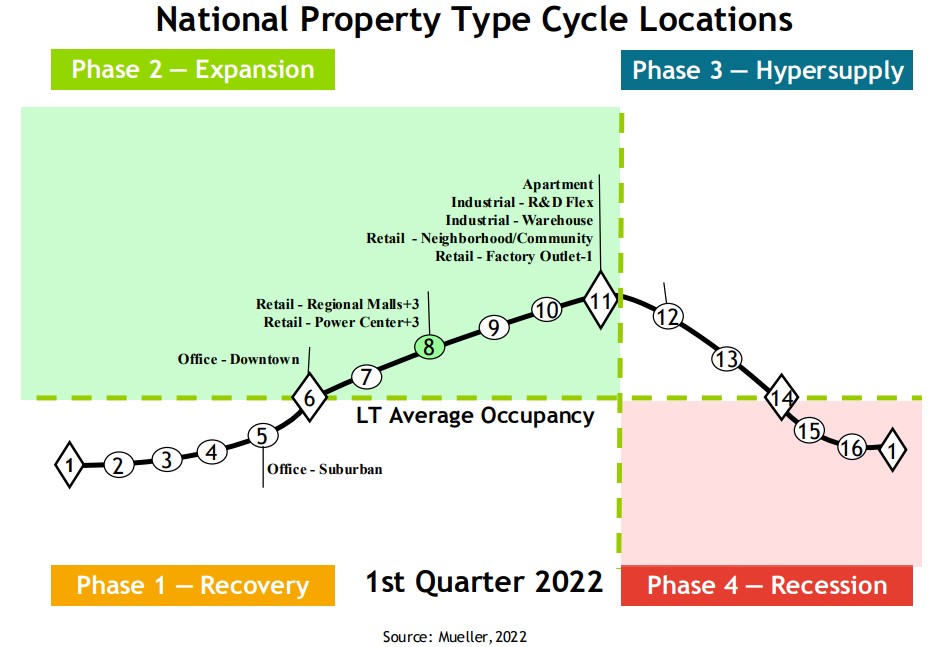

Dr. Mueller’s Q1 2022 report shows the current cycle stage from a national perspective across property types. Apartments, Industrial (Warehouse, Research & Development and Flex Space), and Retail Factory Outlet and Neighborhood/Community (think grocery stores), with growing ecommerce and growing overall demand are in Phase 2 - Expansion _Equilibrium_ Market Level 11 with rents and occupancy levels at cycle peaks. Industrial properties remain at a record high rent rate and occupancy level and record low vacancy rate though JLL reported more than ½ billion square feet is currently in the pipeline.

Downtown Offices remain on the border between Phase 1 – Recovery and Phase 2 – Expansion at Market Level 6. Suburban Offices, however, slipped down to Phase 1 – Recovery as return to the office has become stagnate.

Office is shown in the next table for 54 individual Metros across the country. Eleven of the Metros in Mueller’s study (20 percent) were in Phase 3 – Hypersupply as of Q1 2022. Eight of the metros (15 percent) of the Office markets were in Phase 4 – Recession), with rent growth below inflation or negative. Markets that are shown in _bold italic_ font (11 of the 54 Office markets) make up 50 percent of the total space monitored by Mueller’s report.

Mueller’s quarterly report is based on almost 300 individual econometric models. Unfortunately data for hotels are no longer available.

Pay attention to each of the property types in the report focusing on cities that have excess supply, and also those with supply trailing demand.

To download current and historical quarterly reports click daniels.du.edu/burns-school and scroll down to the REAL ESTATE MARKET CYCLE REPORT section on the Website.

For the Q1 2022 report click Microsoft Word - Cycle Monitor 22Q1.docx (du.edu)

To learn more about Dr Glenn Mueller click daniels.du.edu/directory/glenn-mueller

For commercial real estate practitioners, Dr Mueller’s is essential reading quarterly. Again, thanks to Glenn for exceptional cutting edge commercial research.