March 2021 Fannie Mae-MBA Forecast Summary

Each month Fannie Mae and the MBA release forecasts (both quarterly and annual) for housing and related lending. This summarizes their latest outlook as of March 2021.

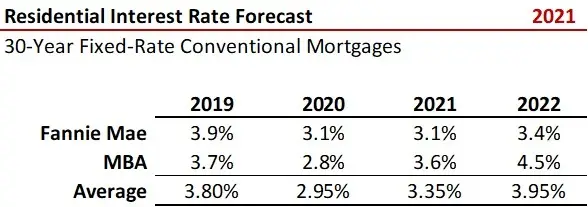

Interest Rates

Not only do Fannie Mae and the MBA disagree on where interest rates are heading, they even see different average rates last year in 2020. Fannie believes the average 30-year fixed-rate conventional mortgage loan averaged 3.1 percent last year and forecasts it will remain unchanged in 2021, then increasing 30 basis points in 2022 to 3.4 percent. The MBA pegged 2020 average rates at 2.8 percent, increasing by 80 basis points in 2021 to 3.6 percent and again by 90 basis points to 4.5 percent in 2022. The table shows their latest prognostication on rates.

Existing Home Sales

Fannie Mae and the MBA both see existing home sales rise in 2021, but the MBA (at 12.8 percent) pegs growth at double that of Fannie Mae (6.1 percent). Fannie is calling for a 5.1 percent drop in 2022 with the MBA seeing sales essentially flat (+0.4 percent). Fannie Mae is more bullish on median home prices in 2021, with an 8.1 percent gain and then up 2.8 percent in 2022. Not surprisingly given higher expected interest rates, the MBA sees median existing home prices up 3.3 percent in 2021 and up just 1.9 percent in 2022. Analysis by the NAHB estimates that every $1,000 increase in home price prices-out 154,000 potential buyers in the housing market.

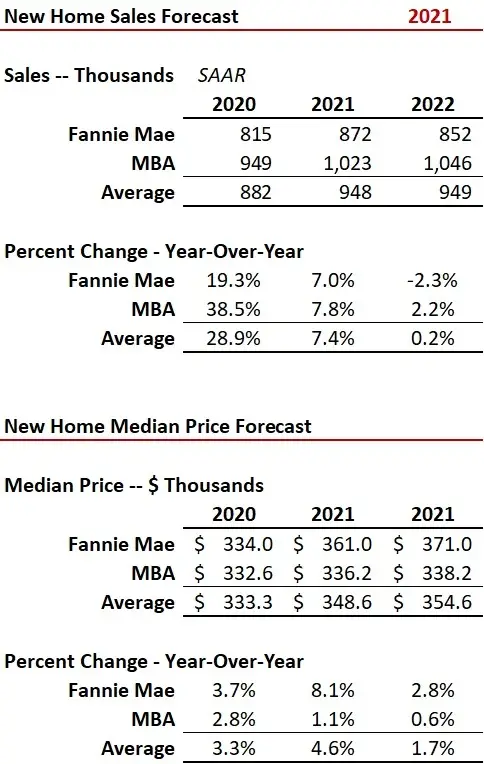

New Home Sales Unlike existing home sales which rise and shrink like the ocean tide, new home sales are also constrained by the head winds and ebb and flow of availability of workers and materials. Though both Fannie Mae and the MBA see rising new home sales at a similar pace in 2021 at 7.0 percent and 7.8 percent, respectively , the number of homes sold is materially different given the assumed difference in new home sales in 2020. The MBA says 949,000 new homes were sold in 2020, 16.4 percent more than the 815,000 estimated by Fannie Mae. Fannie sees new home sales dropping by 2.3 percent in 2022 while the MBA calls for a 2.2 percent gain.

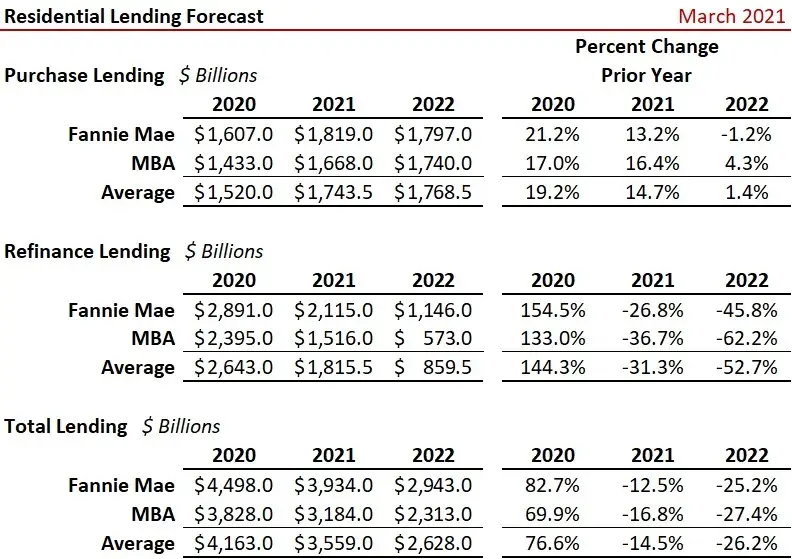

Residential Lending Lending for home purchases is expected to rise by 13.2 percent (Fannie Mae) to 16.4 percent (MBA) in 2021. Fannie sees that dipping by 1.2 percent in 2022 though the MBA calls for a 4.3 percent increase. Each party sees refinance lending drop in 2021 (Fannie -26.8 percent, MBA -36.7 percent) and down again in 2022 (Fannie -45.8 percent and the MBA -62.2 percent).

Black Knight estimates that 11.2 million homes would benefit from refinancing saving an average $277 each per month. The MBA says there are $11.755 trillion in total residential loans outstanding. The 2020 homeownership rate was 65.8 percent. There were 82.808 million owner-occupied homes in Q4 2020 with an estimated 60 percent having a loan. Thus an estimated 49.685 million homes have loans at an average $236,590. Therefore the 11.2 million homes would have a potential $2.650 trillion in total refis. As March, the MBA is forecasting $1.516 trillion in refis in 2021 and Fannie Mae is at $2.114 trillion in refis. Though refi volume is going to drop, the potential remains strong.

Despite the pandemic and economy in 2020, the year saw U.S. personal income set an all-time record of $19.7 trillion, up $1.1 trillion (+6.1 percent), driven by stimulus payments and government aid. With a $1,400 per person stimulus already out the gate in 2021, another record appears likely. Rising rates, however, will ultimately have a negative impact on housing sales, and both purchase and refinance lending volumes.