Existing Home Sales June 2020 -- Extraordinarily Nimble in a Catastrophic Economy

Given the record 32.9 percent plunge in U.S. GDP in Q2 2020 (advanced estimate), June 2020 existing home sales levels could be described as unexpectedly _resilient_, down just 11.3 percent year-over-year on a seasonally adjusted annualized rate (SAAR) according to the National Association of Realtors® (NAR). That descriptor rises to _extraordinary_ when viewing the year-over-year decline of just 3.4 percent based on analyzing the raw (not seasonally adjusted) total monthly sales, which dipped from 528,000 in June 2019 to 510,000 in June 2020. Sales were off just 7.9 percent in the first six-months of 2020 when compared to the same period a year earlier.

Median prices continued an upward trajectory, hitting an all-time high of $295,300 in June 2020, up 3.5 percent year-over-year, and average price at $329,900 (also a record high) up 2.6 percent. The following graph shows sales on a SAAR basis and median prices monthly commencing January 2014.

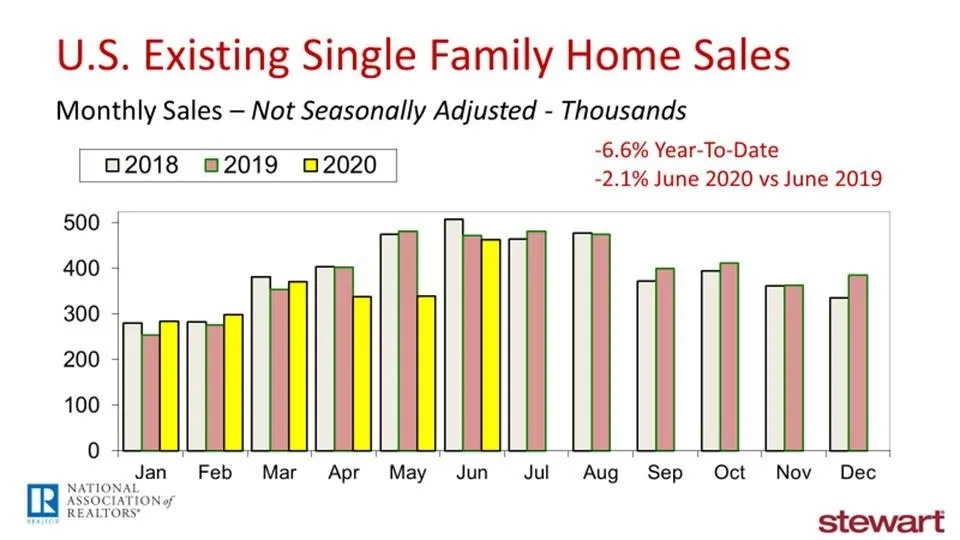

The level of sales performance is not equal across housing types though, as seen when comparing single-family numbers to condominium and co-op sales. The first graph below shows the monthly numbers for single family houses while the second details condo and co-op sales numbers. Single family sales were off just 6.6 percent year-to-date versus an 18.4 percent plunge in condominium and co-op sales. On a year-over-year comparison for June, single family was down just 2.1 percent versus a 14.5 percent drop for condos and co-ops. While there has been an obvious downward bias in multifamily-type properties since the pandemic hit, that appears to be muting somewhat.

Other details in NAR’s press release included:

- Median home prices have now risen 100 consecutive months on a year-over-year basis

- Though distressed home sales are a minimal 3 percent of the total volume, that is up 50 percent from the 2 percent level recorded in June 2019

- Available inventory of homes available for sale continues to shrink, down from 1.92 million listings on the market as of the end of June 2019 to 1.57 million this June. On a months-inventory perspective (with six-months considered normal), there was a 4.0 month supply at the end of this June compared to 4.8 months a year ago. This perpetuates the Seller’s Market perspective

- 1 st -time homebuyers acquired 1-in-3 homes sold in June (35 percent) – essentially unchanged from a year ago

- Individual investors bought 1-in-every 9 homes sold in June 2020, almost identical to the 1-in-10 in June 2019

- Buyers paid all-cash for 16 percent all closings

To read the entire NAR press release click https://www.nar.realtor/newsroom/existing-home-sales-climb-record-20-7-in-june

Bolstering housing sales were all-time record-low interest rates in Q2 2020, with a forecast from Fannie Mae for further 30-year mortgage rate declines into 2021, slipping to 2.8 percent average in Q3 2021.

Home sales remain dependent on jobs. There still remains a potential material bump-up in unemployment as many more businesses may fail given the cash-burn from prior stimulus payments and uncertainty of ongoing governmental aid.

Still, given the massive plunge in the total value of all goods and services produced in country in Q2, housing sales were remarkable.

Ted